London investment is liquid and secure, offering long-term returns.

London is a global leader in finance, innovation, sustainability, diversity, and education. Our unrivalled financial centre status, coupled with our booming innovation and technology ecosystem, attracts businesses and talent from across the world. Our commitment to sustainability and connectivity further enhances our demand allure and sets us apart, globally.

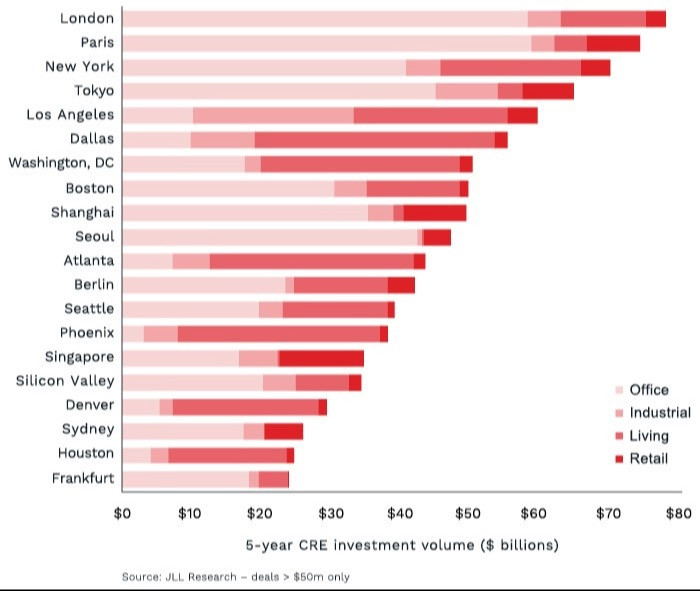

London is consistently among the largest markets traded globally for international real estate investment, with over £250bn in the past decade.

|

High levels of liquidity, as the second most traded global real estate market last year with transaction volumes exceeding £31.3bn, behind only the USA. |

The UK again ranked #1 in JLL Global Real Estate Transparency Index 2022, while London was #1 in city index. |

|

Strength of academic institutions, with 4 UK universities in the top 10 of QS World University Rankings 2024, 2 of which are in London. |

Established industries such as financial and professional services - London ranks 2nd in Z/Yen Global Financial Centres Index 2023. |

London leads the world in our six Strategic Asset Classes for investment:

|

Low Carbon |

Life Sciences |

|

Leisure and Culture |

Logistics & Light Industrial |

|

Living |

Learning & Institutions |

Europe's top financial centre, second only to New York globally.

Robust financial industry attracts businesses, investors, and professionals from around the world.

Over £20 billion in cross-border investments in 2022, indicating London’s strong attractiveness to global markets.

The world’s largest airport system, with London’s biggest airport (Heathrow) surpassing pre-pandemic passenger levels.

A thriving ecosystem for startups and established tech giants, supported by a high concentration of skilled tech professionals.

The largest destination for venture capital in Europe ($79.6 billion over past three years according to Pitchbook) and fourth-largest globally

The highest number of $1 billion+ tech businesses in Europe, a testament to our supportive environment for technological innovation and entrepreneurship).

More than 300 languages spoken

Unmatched diversity enriches the fabric of the city, fostering a global outlook and cultural exchange.

Four UK universities in the top ten of the QS World University Rankings 2024, two of them in London.

Highly educated workforce and magnet for top students from around the world.

More parks than any other city in Europe, making London one of World's greenest capitals.

The world's largest Low Emission Zone, encouraging eco-friendly practices and combating air pollution.

London’s pioneering underground system keeps growing, with the recently-opened Elizabeth Line extending fast and clean transport to 1.5 million people.

|

Attractive relative pricing, and a track record of strong price and rental growth returns. |

A hub of talent and innovation, with London among small top tier of ‘global leaders’ in JLL Innovation Geographies 2022. |

|

Growth industries such as science and technology - UK tech ecosystem valued at just under $1tn in 2023 according to Tech Nation, placing it third in the world. |

|

London is anchored by its resilient real estate market, consistently attracting high levels of investment. It has observed a flight to quality in the office market and a more mature living sector than much of Europe, which have boosted London’s five-year investment volume to the highest in the world.

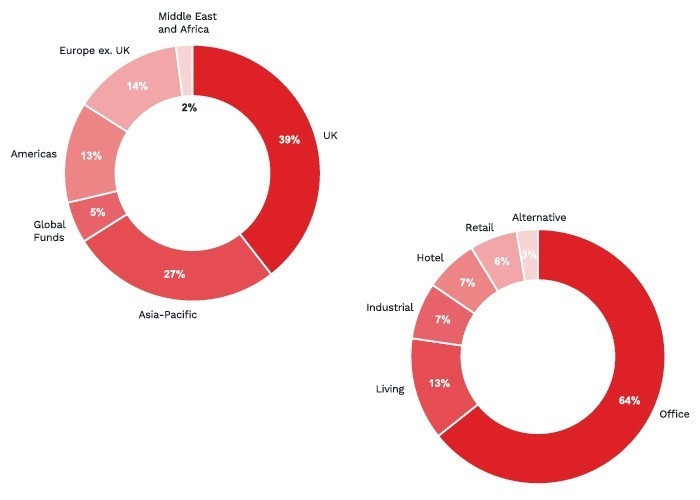

International investors remain highly active in the UK and in London in particular. Through weaker global real estate investment in 2023, London investment volumes of £11.2bn included 61% of capital from outside the UK. US investors have been critical in seeking opportunistic assets at this point in the cycle, complemented by a wide spectrum of Middle East and Asian capital. The diversified pool of capital is a key driver of market liquidity for London.

Offices remained the dominant sector for investors (64%). London’s diverse corporate occupier base extends demand for offices from financial and business services to technology and innovation sectors. Life sciences have become a particular standout sector, where investors seek to take advantage of London’s role in the Golden Triangle (alongside Oxford and Cambridge), Europe’s largest life sciences cluster.

It is notable that across Europe, Living made up an equal share of activity and this rise of Residential, Student and Later Living is now a key feature of the UK real estate investment landscape. This includes affordable housing solutions, where sector fundamentals of a severe supply/ demand imbalance also align with investor ESG motives to invest with social purpose. Living sectors continue to broaden opportunities for real estate investors as they mature.